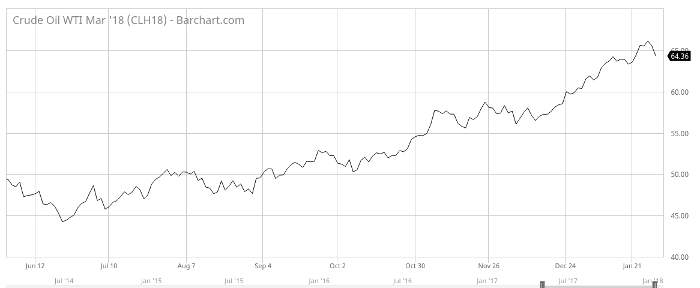

WTI crude is trading for $64.31 per barrel as I write this.

And it’s not just my veteran readers who believe it’s going to move higher in 2018. It was only a few weeks ago that I told you we could be in for another price jump… with some of my colleagues even more bullish than me.

Yes, WTI is going to continue this run. Remember, prices have jumped roughly 43% since early July and over 130% since bottoming in February of 2016.

I’m not saying everyone agrees with that sentiment.

In the rosy projections coming from both the EIA and IEA over U.S. oil production this year, we’re told the same narrative: U.S. oil will flood the market and drive prices back to $30 per barrel!

The EIA has estimated that the United States’ domestic crude production will average 10.3 million barrels per day this year, then jump to 10.8 million barrels per day in 2019.

Now, I won’t argue that oil output in the U.S. is going to increase.

It will… and that’s a good thing.

West Texas Forever

What the last oil downturn (between 2014 and 2016) taught us is that we’re officially all in on tight oil.

In 2016, approximately 70% of the oil and natural gas wells drilled in the U.S. were horizontal wells.

Every single one of those wells needs to be hydraulically fractured.

There’s simply no way around it.

Yet it’s not just a question of how much; rather, it’s where we’re getting our oil supply.

Moreover, we’re extracting approximately 5.2 million barrels of crude per day from just three regions: the Bakken, Eagle Ford, and, of course, the Permian Basin.

That represents more than half of our entire supply!

Unfortunately, not all shale plays were created equal.

And you can expect West Texas to carry the brunt of the shale load in the coming years.

ExxonMobil just announced it’s going to triple daily production in its Permian operations to 600,000 bbls/d by 2025 and pump more than $2 billion into terminal and transportation expansions.

Trust me, it isn’t the only one with that mindset.

In fact, the number of rigs drilling for crude oil in the Permian Basin has swelled to over 400. To put that into perspective, keep in mind that there are only 759 such rigs drilling for oil in the U.S. right now.

At its current pace, Permian production will soon top 3 million barrels per day.

Ah, but I can hear you ask the question now, dear reader.

“Won’t this flood the market with crude oil and drive prices lower?”

Good question.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Tapping the Thirsty Dragon

If we take the EIA at its word, global demand will top 100.1 million barrels per day in 2018 and 101.76 million barrels per day in 2019.

That’s a slight 1.7% increase this year.

Thing is, the oil markets may be tighter than you first think.

Not only is the OPEC/non-OPEC production cut deal still holding steady (both the Saudis and Russia are complying more than most would’ve thought possible), but there are two wild cards to consider.

The first is the ticking time bomb known as Venezuela.

Daily horror stories are now coming out of the country.

Between the corrupt Maduro regime, an increasingly volatile populace that has to resort to looting to keep from starving, and an oil industry struggling to get a grip on falling production… it’s only a short matter of time before Venezuela collapses into chaos.

That’s assuming, of course, that things can get any worse than they are now.

Given the rate at which Maduro’s soldiers are deserting their posts (I last read that 1,200 soldiers didn’t come back from their Christmas holiday), I can’t help but ask you how much longer you think Maduro can hold on.

Once that coup takes place, oil production will plummet all the way to zero.

I wouldn’t be surprised to see Russian and Chinese workers take over PDVSA’s rigs, especially considering that the country has been paying off its debt in barrels of oil.

We also have to consider the fact that those Permian producers can now tap global markets.

That opens up one huge market for them: Asia.

After taking over the title of the world’s largest oil importer, China swallowed up roughly 8.4 million barrels per day in 2017, a 10.1% jump over the previous year.

In 2018, China is expected to import an average of 9 million barrels per day, while producing less than 4 million barrels per day.

If you think we have it bad with our oil addiction, it’s nothing compared to China.

And it’s a perfect place for Texas crude.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.